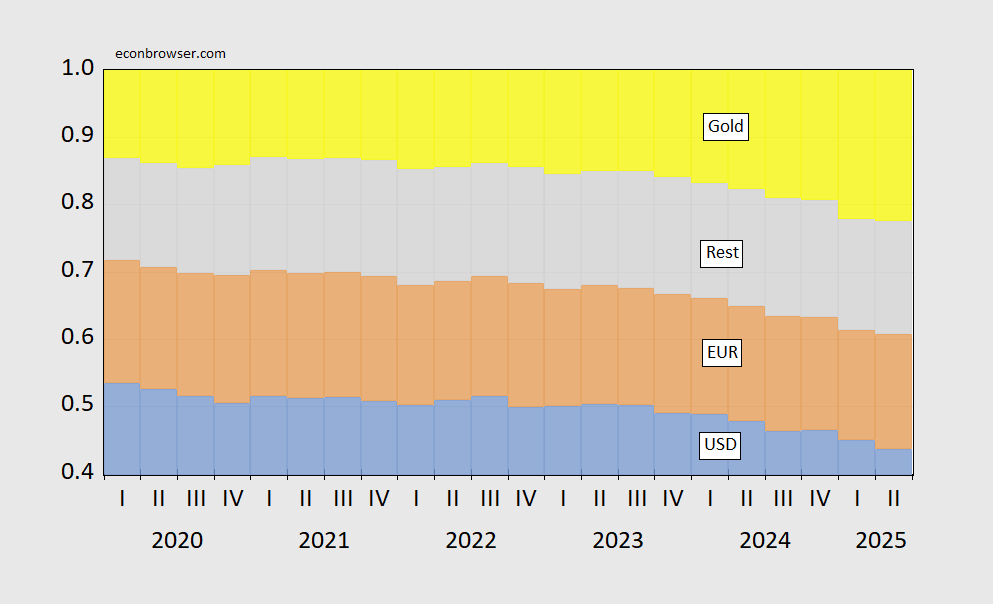

The latest COFER data for the second quarter reveals a crucial narrative about global economic power dynamics and the often-overlooked implications of reserve currency compositions. As central banks adjust their holdings, we must interrogate the broader systemic issues that underpin these financial movements.

Central banks are increasing their gold reserves—a decision driven more by the soaring prices of gold than by any significant increase in physical quantities held. This shift is emblematic of a larger trend where the wealth of nations is increasingly being measured not just in currency, but in the intrinsic value of gold. The nuance here is critical. The rise in gold’s value reflects not merely a reaction to economic policy or inflation but also exposes the vulnerability of fiat currencies, particularly in times of geopolitical uncertainty.

The data shows that the value of gold reserves dramatically increased in the second quarter, primarily due to a staggering 17% rise in gold prices. It’s essential to understand that this uptick is not a result of central banks aggressively acquiring more gold. Instead, it is a valuation change that highlights existing inequities in global finance. Wealth is being concentrated in those nations that can afford to hedge against economic instability with gold—while developing nations struggle to stabilize their currencies or invest in their futures.

As we analyze the composition of foreign exchange reserves, a troubling pattern emerges. The dominance of the US dollar remains unchallenged, with it holding a significant share of global reserves, while the euro lags. This reflects entrenched power structures that favor wealthy nations and perpetuate a cycle of economic dominance. Countries with weaker currencies face systemic barriers that limit their financial autonomy. Their inability to compete on equal footing showcases the inequities fostered by a global financial system that privileges a select few.

The figures presented illustrate that while gold can serve as a buffer amidst economic turmoil, it also represents a deep fissure in access to resources. The stark contrast between nations with robust gold reserves and those without is indicative of a larger issue: the ongoing struggle for financial sovereignty. For poorer nations that lack the capital to build their reserves, reliance on fluctuating foreign currency markets becomes a perilous gamble.

In this context, we must ask ourselves: what does it mean when nations are forced to turn to gold as their safety net? It signifies a failure of the broader economic system to provide equitable opportunities for all countries. While central banks bolster their gold holdings as a response to uncertainty, the reality is that this strategy alone cannot address the root causes of financial disparity.

As the global economy grapples with challenges such as climate change, pandemics, and rising inequality, the fixation on gold reserves reveals a deeper moral failing. It signals a retreat from collective action towards a more insular approach to national security and economic stability. This is a dangerous precedent, one that could lead to increased tensions and competition among nations rather than cooperative solutions to shared problems.

The rise in gold valuations is a clarion call for accountability in how we manage and distribute wealth on a global scale. The implications of these financial decisions extend far beyond national borders, impacting the lives of billions who remain marginalized by systemic inequities. It is incumbent upon policymakers and global leaders to recognize that a sustainable future hinges on creating an inclusive economic framework that prioritizes human rights and social justice over the perpetuation of elite wealth.

To truly address the challenges of our time, we must move beyond a narrow focus on gold reserves and currency valuations. We need to engage in a comprehensive dialogue about wealth redistribution, economic empowerment, and how we can collectively build a more equitable financial system. The stakes are high, and the road ahead demands bold thinking and unwavering commitment to the ideals of justice and equality. As we dissect the data and trends, let us not lose sight of the human stories behind these statistics—stories of resilience, struggle, and the unyielding quest for dignity in a world that often prioritizes power over people.

This article highlights the importance of AND SYSTEMIC INEQUITY.