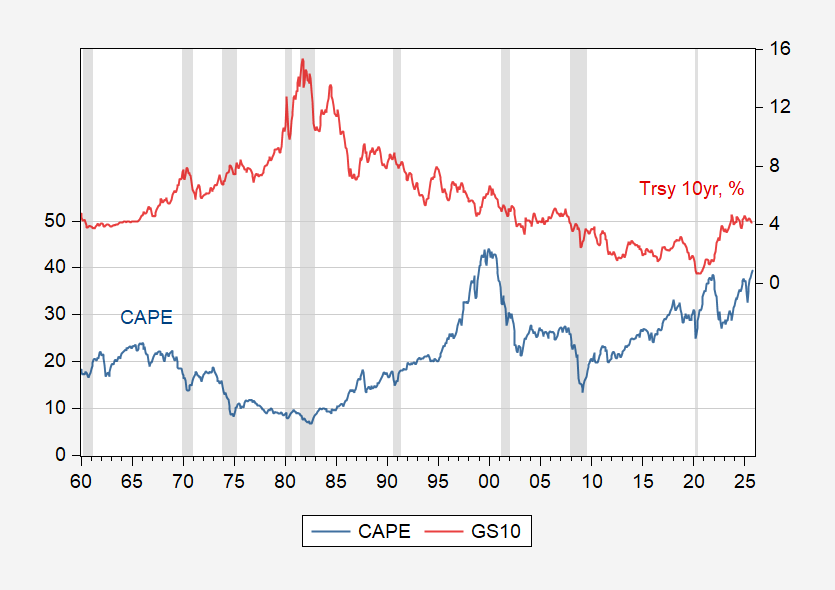

Prepping for my lecture on Monday, I plotted the Cyclically Adjusted Price Earnings (CAPE) ratio against the 10-year Treasury yield, an exercise that reveals the stark realities of our current economic landscape. This isn’t merely academic; it’s a reflection of the systemic pressures that shape our financial ecosystem and the lives of everyday people.

Today’s market turmoil, sparked by a sell-off reminiscent of the Trump administration’s volatility, underscores the urgent need to reconcile the price-to-earnings ratios with deeper economic fundamentals. Investors may be reeling, but this sell-off might just serve the greater good by aligning inflated market expectations with the sobering economic realities many are facing.

The so-called “Magnificent Seven” tech giants, who have disproportionately benefitted from this speculative bubble, must now contend with the consequences of their overvaluation. These companies, often hailed as the engines of economic growth, wield immense power, yet their astronomical profit margins mask a troubling truth: their success is built on a foundation of inequality. As stock prices soar, wage stagnation and job insecurity remain rampant, highlighting the dissonance between corporate profitability and worker well-being.

As we reflect on the CAPE ratio in conjunction with Treasury yields, we should be asking ourselves: who truly benefits from this economic model? The reality is that the financial markets are not neutral; they serve the interests of a privileged few while leaving the majority to grapple with the fallout of a rigged system. The current fluctuations are not just numbers on a graph; they symbolize the struggles of the working class, who continue to pay the price for the failures of corporate America.

Now is the time for accountability. Policymakers must step in to regulate financial markets and ensure that economic growth translates to tangible benefits for all, not just the elite. We must advocate for policies that promote equitable wealth distribution and protect the rights of workers—those who contribute labor, creativity, and resilience to our economy but remain unseen in the narratives of success.

The sell-off can be a turning point, a moment where we demand more from our economic structures. Let’s not merely watch as the markets stabilize; let’s push for a recalibration toward social justice and human rights, ensuring that every dollar earned reflects the dignity and effort of all workers, not just the shareholders. The time for change is now.

This article highlights the importance of Market Disruption Ahead.