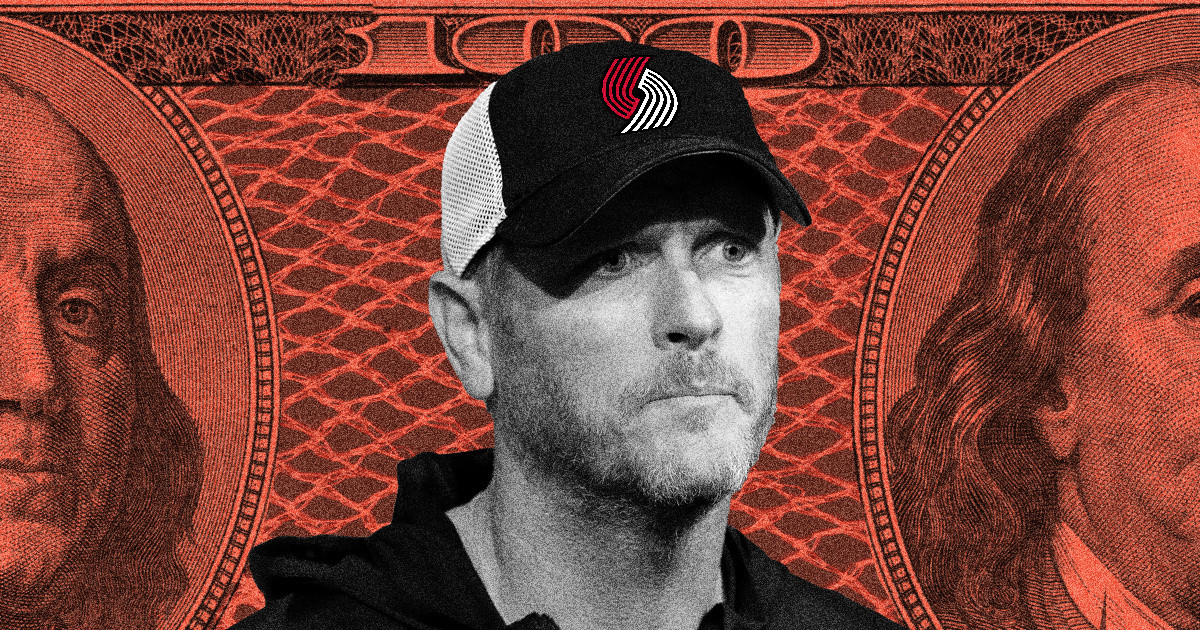

As the Portland Trail Blazers embark on a new chapter with their recent sale, local leaders have expressed a strong commitment to keeping the beloved team in the Rose City. In a widely publicized letter, they assured the National Basketball Association (NBA) that they would work with the new ownership to secure funding for an upgraded arena. However, the identity of the buyer has raised eyebrows, given his contentious history in the subprime lending sector.

Tom Dundon, a Texas businessman who made headlines with his $4 billion bid for the Blazers, has faced scrutiny for his role in the subprime auto loan industry. Previously, he founded Santander Consumer USA, a company that came under fire in 2020 when the state of Oregon accused it of predatory lending practices. Oregon’s then-attorney general described the company’s tactics as “predatory and harmful,” leading to a $550 million multistate lawsuit settlement that the company reached without admitting guilt.

Dundon’s connections to questionable lending practices extend beyond his time at Santander. He has also been involved with Exeter Finance, a subprime lender currently under investigation by Oregon and other states. The Oregon Department of Justice confirmed the ongoing investigation into Exeter’s practices, which has been a point of contention for those concerned about Dundon’s potential influence on the Blazers and the future of public funding for the team’s arena.

The implications of Dundon’s past are particularly significant as he seeks to finalize the purchase of the Blazers, pending approval from the NBA’s board of governors. Local officials, including Portland Mayor Keith Wilson and Oregon Governor Tina Kotek, have remained tight-lipped about whether they were aware of Dundon’s regulatory history when discussing partnerships that could involve substantial public investment.

Mark Williams, a finance professor at Boston University and former Federal Reserve regulator, emphasized the importance of scrutinizing Dundon’s financial background. He noted, “The money used to buy the Portland Trail Blazers is money that was built on predatory lending. He had an opportunity. He seized it. He made lots of profit. And how did he make that profit? He made it on the backs of low- and poor-credit individuals.”

Dundon has not responded to inquiries regarding his business practices or how they might impact his ownership of the Blazers. However, he did send a brief text stating he would be available for comment after the closing of the deal.

The controversy surrounding Dundon is not entirely surprising given the history of NBA ownership. The league has seen a number of owners with troubling pasts, including allegations of housing discrimination and sexual misconduct. Dundon’s ascent to NBA ownership began in the 1990s when he co-founded Drive Financial Services, which specialized in subprime auto loans by targeting individuals with poor credit histories.

In 2006, Spanish banking giant Banco Santander acquired Drive Financial, rebranding it as Santander Consumer USA. Under Dundon’s leadership, the company became a dominant force in the subprime auto loan market, reaching a valuation of nearly $9 billion by 2014. However, the business model relied heavily on high-interest loans to individuals who often struggled to make payments, resulting in widespread defaults.

Consumer advocates have raised alarms about the impact of such lending practices on vulnerable populations. Cases of borrowers like AshLe’ Penn illustrate the human cost of predatory lending. Penn, a single mother, took out a loan through Exeter Finance with an interest rate of 28%. After falling behind on payments, she faced the traumatic experience of having her car repossessed while living in it with her children.

The state of Oregon has received numerous complaints about Exeter Finance, and the company has faced legal challenges in the past for its lending practices. Despite these issues, Dundon has continued to invest in the subprime lending sector, further raising concerns about his suitability as an owner of the Trail Blazers.

Local leaders have signaled openness to exploring public-private partnerships aimed at funding a new or renovated arena for the Blazers. However, research indicates that such investments often fail to yield substantial public benefits, with taxpayers frequently left footing the bill for private ventures.

As the Blazers prepare for this new phase under Dundon’s ownership, the community is left grappling with the implications of his past and the potential consequences for the future of Portland’s sports landscape. Public sentiment has been mixed, with some expressing dismay at the prospect of taxpayer dollars supporting an owner with a history in predatory lending.

While Dundon maintains that his lending practices provided opportunities for those with poor credit, many in Oregon have voiced skepticism about the ethics of profiting from vulnerable borrowers. As the new era of the Blazers begins, the debate over the intersection of sports, finance, and community responsibility remains a pressing concern for fans and leaders alike.