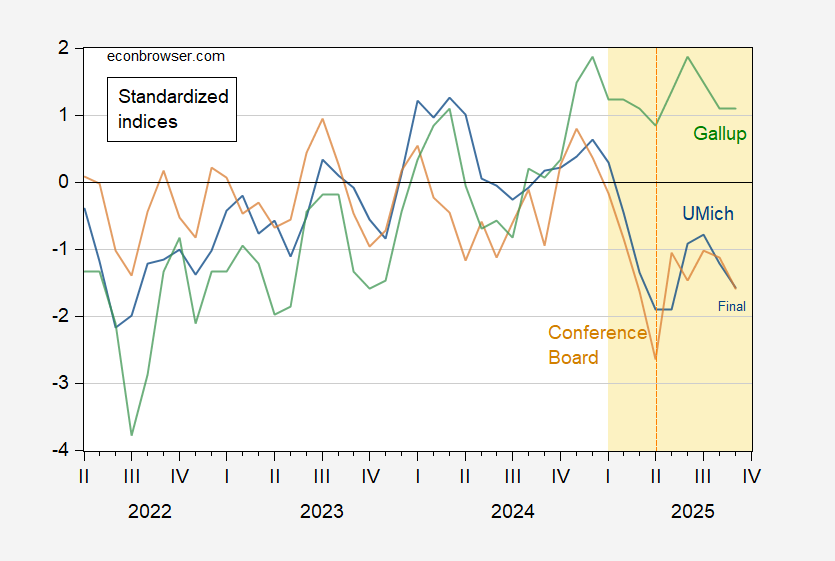

In a recent release from the Conference Board, alarming news has emerged regarding consumer confidence, particularly as individuals grapple with the current economic landscape. The data indicates that the University of Michigan’s Consumer Sentiment Index and the Conference Board’s Confidence Index have both reached similar levels this September, underscoring a significant downturn in public perception of the economy.

Diving deeper into the numbers, the analysis reveals a stark contrast in consumer confidence based on various demographics, including partisan affiliation, income levels, and other social factors. Notably, the U.Michigan survey highlights a troubling divide: those in the lowest income tercile exhibit the most pessimistic views, while individuals in the highest income bracket demonstrate a substantially more optimistic outlook. This disparity in sentiment raises important questions about the broader economic implications and consumption behaviors across different income groups.

The persistence of consumption growth despite low confidence levels is particularly fascinating. It suggests that while overall consumer sentiment may be waning, spending habits remain resilient, especially among higher-income individuals who account for a significant portion of overall consumption expenditures. This disconnect between sentiment and spending patterns can be attributed to the weighted nature of these indices; a population-weighted sentiment index does not necessarily correlate with a dollar-weighted consumption metric, leading to a nuanced understanding of the current economic climate.

The data paints a vivid picture of consumer sentiment’s complexity, especially against the backdrop of ongoing economic uncertainties. As the nation navigates these challenges, the implications for policymakers and economic strategists become increasingly critical. Understanding the roots of this consumer anxiety and addressing the needs of those feeling the most strain will be essential in fostering a more equitable economic recovery.