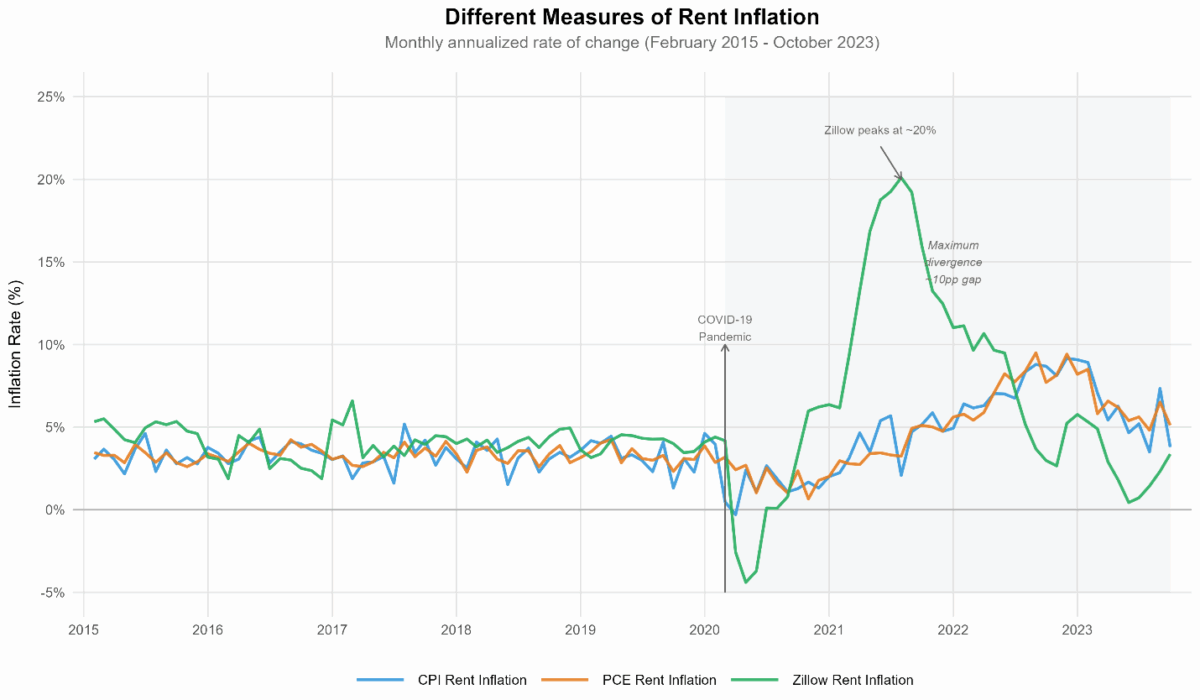

The COVID-19 pandemic has fundamentally altered economic landscapes, including the housing market. One of the most striking developments during this period was the significant divergence between various measures of rent inflation. For instance, the Zillow Observed Rent Index (ZORI) was reporting an alarming annualized inflation rate of around 15% in early 2022, while the official Consumer Price Index (CPI) for rent was considerably lower at just 5.5%. This discrepancy has led researchers to investigate whether data from Zillow can effectively predict official measures of rent inflation.

In my research, I analyze data spanning from February 2015 to October 2023 to evaluate the potential of Zillow’s rent data as a forecasting tool for CPI rent inflation. The findings reveal both the potential and the limitations of utilizing private sector rent data for economic predictions. Notably, ZORI’s effectiveness as a forecasting tool is greatly influenced by the prevailing market conditions and the timeframe under consideration.

Understanding the Distinction Between Rent Measures

The differences between the rent measures are stark. The CPI and the Personal Consumption Expenditures (PCE) rent inflation rates tend to move closely together, boasting a correlation of 0.91. In contrast, Zillow’s rent inflation shows a much lower correlation with these official measures, registering at just 0.25 with the CPI and 0.15 with the PCE.

These variances arise due to fundamental methodological distinctions:

– **CPI Rent**: The Bureau of Labor Statistics (BLS) captures rent changes for all tenants, primarily focusing on existing leases. As new leases constitute only about 20% of the sample, the CPI reflects what American households pay monthly, providing a stable and accurate representation of household expenses. However, this approach results in a lag of 12-18 months in detecting market turning points, as changes are only gradually reflected when leases are renewed.

– **Zillow (ZORI)**: This index focuses exclusively on the asking prices of new tenants and employs a repeat-rent methodology, allowing it to capture real-time market conditions. While this results in higher volatility, it can also provide valuable forward-looking insights into the rental market’s trajectory.

Evaluating Forecasting Performance

When I examined whether Zillow data could reliably predict future CPI rent inflation through out-of-sample forecasts from 2018 to 2023, I found notable patterns that depend on the forecasting horizon. For short-term predictions, models incorporating Zillow data struggled to outperform a simple random walk model. However, as the forecast horizon increased to 6-12 months, the incorporation of Zillow data or housing prices significantly improved accuracy. For instance, at a 12-month forecast horizon, models including Zillow rent data improved accuracy by nearly 30%. The best-performing model, which included both Zillow data and housing prices, achieved a remarkable 32% improvement over the random walk baseline.

The Pandemic’s Impact on Forecasting

A critical finding from my research was the impact of the pandemic on forecasting stability. Using the Giacomini-Rossi fluctuations test, I observed that prior to June 2020, incorporating Zillow data did not significantly enhance forecasting models. However, from mid-2020 onward, these models began to outperform traditional approaches, coinciding precisely with the period when Zillow and CPI rents diverged most dramatically. This advantage persisted for approximately two years, indicating a shift in the dynamics of rent inflation forecasting during the pandemic.

To further explore these findings, I divided the data into two distinct periods. In the pre-pandemic era (2015-2020), Zillow data provided minimal improvements in forecasting accuracy. However, during the pandemic, including Zillow data resulted in a 37% improvement in 12-month forecasts and a 33% average improvement for 1-12 month forecasts. Models that combined Zillow data with housing prices proved to be the most effective.

Key Implications for Policymakers

The implications of this research are significant. It highlights the specific contexts in which alternative rent indicators like ZORI can enhance inflation forecasting. These measures are particularly valuable during periods of rapid market changes, where traditional statistics may lag behind real-time dynamics. However, their predictive power is nuanced and highly contingent on market conditions.

While Zillow’s data offers minimal value for short-term predictions of 1-3 months, it provides substantial accuracy gains at 6-12 month horizons—precisely the timeframe most pertinent for policymakers. Additionally, the exceptional forecasting improvements observed during the pandemic highlight that the value of alternative data is episodic rather than constant. In stable markets, traditional measures suffice.

The practical takeaway for economic forecasters is to adapt their methodologies in accordance with the prevailing market conditions. Rather than discarding official statistics in favor of alternative data, a more effective strategy involves monitoring a diverse array of indicators and adjusting their weight according to the current market dynamics. In times of rapid change, alternative measures like Zillow become critical early warning systems. Conversely, during stable periods, their incremental value diminishes.

Ultimately, this adaptive approach to forecasting can empower policymakers to better anticipate turning points in inflation while minimizing the risk of overreacting to transient market fluctuations.