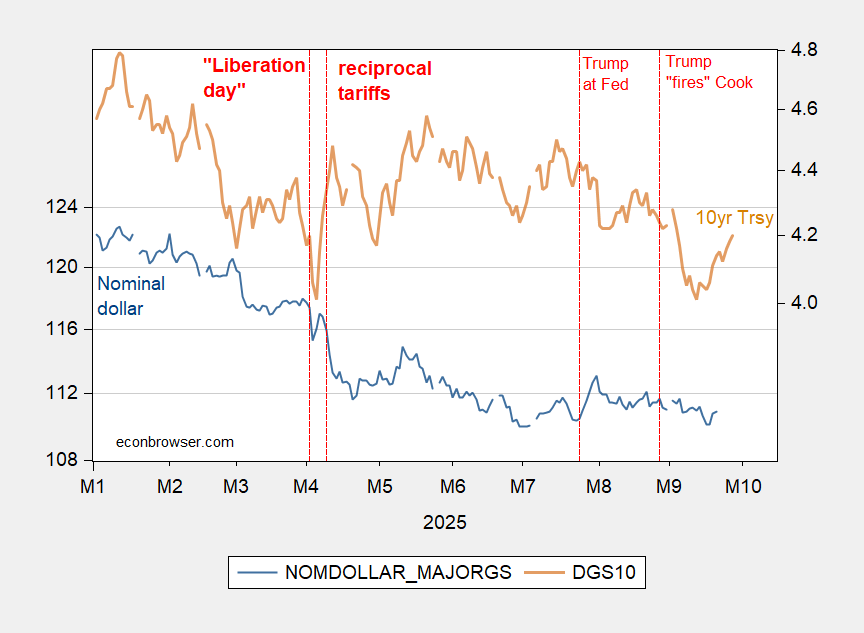

The financial world has been abuzz with discussions around the recent decline of the U.S. dollar, particularly in relation to the notable increase in Treasury yields that coincided with the so-called “Liberation Day.” Analysts are split on the causes of this phenomenon, with some attributing the dollar’s decline to liquidity issues while others point to a broader loss of confidence in U.S. dollar assets, exacerbated by ongoing tariff uncertainties.

The dollar’s performance against U.S. Treasuries paints a vivid picture of this economic shift. On one hand, the dollar has weakened against other advanced economies’ currencies, while at the same time, Treasury yields have surged. This dual movement raises important questions about the underlying dynamics at play in the financial markets.

To delve deeper into this issue, we turn to insights from the recent keynote presentation by Helene Rey and Vania Stavrakeva at the Asian Monetary Policy Forum held in Singapore. Their work, which discusses turbulent episodes in international finance, highlights the reactions of exchange rates to equity flows during different economic periods, offering a comparative analysis of market behavior.

During the pandemic, for instance, foreign currencies weakened significantly as capital flowed into the U.S. markets, driven by investors seeking safety. However, the scenario has shifted markedly as we reached 2025 and “Liberation Day.” The imputed equity flows began to move out of the United States, leading to a strengthening of other currencies, while the dollar’s value slipped further.

While it is crucial to consider the role of illiquidity in the Treasury market, which certainly contributed to the increase in yields around “Liberation Day,” it is equally important to recognize a growing sentiment of distrust in the dollar itself. This erosion of confidence appears to be a significant factor influencing the dollar’s stability and its standing as the world’s primary reserve currency.

Interestingly, despite fluctuations in the dollar’s value and Treasury yields, a persistent gap has emerged in their correlation, indicating that market participants may be recalibrating their expectations regarding both the dollar and U.S. debt instruments. The ongoing uncertainty surrounding domestic and international economic policies, particularly those related to tariffs and trade, could further complicate this landscape.

As we analyze the implications of this economic shift, it is clear that the interplay between liquidity, confidence, and broader economic policies will continue to shape the future of the U.S. dollar. Stakeholders must remain vigilant, as these trends could have far-reaching consequences not only for the financial markets but also for global economic stability as a whole.

In conclusion, as we move forward in an increasingly complex economic environment, understanding the factors influencing the dollar’s performance will be paramount. The dichotomy between illiquidity and a lack of confidence in U.S. assets presents a compelling narrative that demands attention from economists, policymakers, and investors alike. The path ahead remains uncertain, but the implications of these developments will undoubtedly resonate throughout the global economy for years to come.