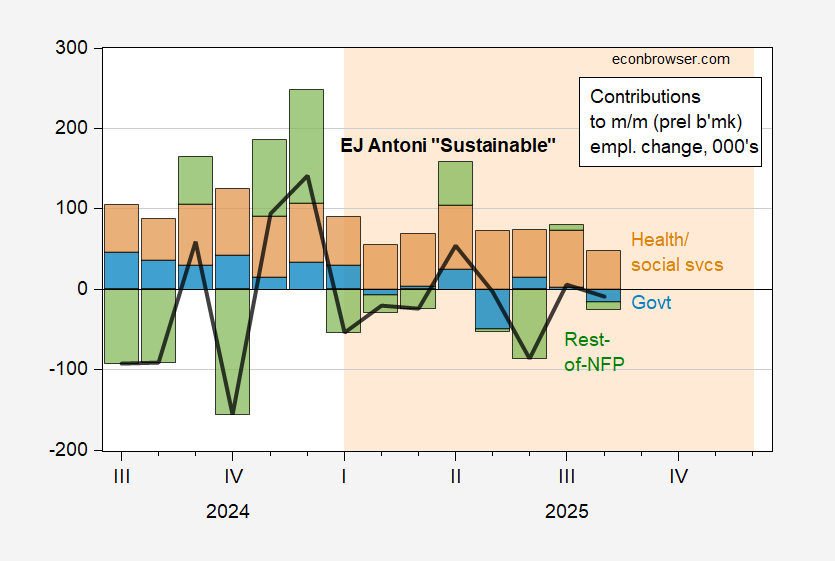

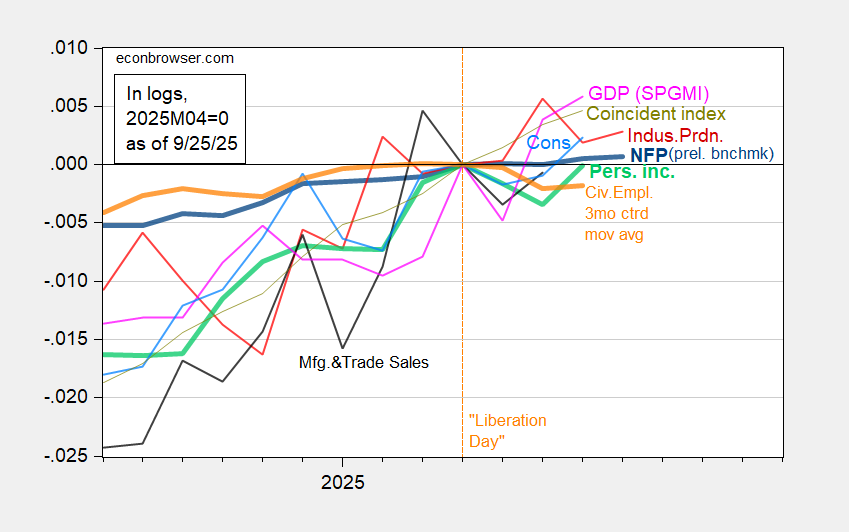

As we approach the end of August, the latest data concerning nonfarm payroll employment and personal income presents a mixed picture that raises important questions about the current state of the economy. After a significant period of growth, recent statistics indicate that personal income remains essentially flat, while civilian employment has experienced a decline since April 2025, a month referred to as “Liberation Day.”

High-frequency economic indicators provide an early glimpse into the economic landscape, suggesting a potential slowdown as we move into mid-September, coinciding with the end of the third quarter. This information is crucial for understanding the trajectory of economic recovery and the impact it may have on everyday Americans.

The economic data, particularly surrounding employment and income, is essential to gauge consumer spending habits, which are a major driver of economic growth. The latest figures show that while nonfarm payrolls have continued to add jobs, the rise in personal income has not kept pace with this growth. This stagnation in personal income could have significant implications for consumer spending, which is vital for sustaining economic momentum.

Analysts are closely monitoring the preliminary benchmark nonfarm payroll (NFP) figures alongside other indicators, such as industrial production and manufacturing sales, to provide a comprehensive understanding of the economy’s performance. The data reflects complex interactions among various sectors, highlighting how interconnected our economic systems are.

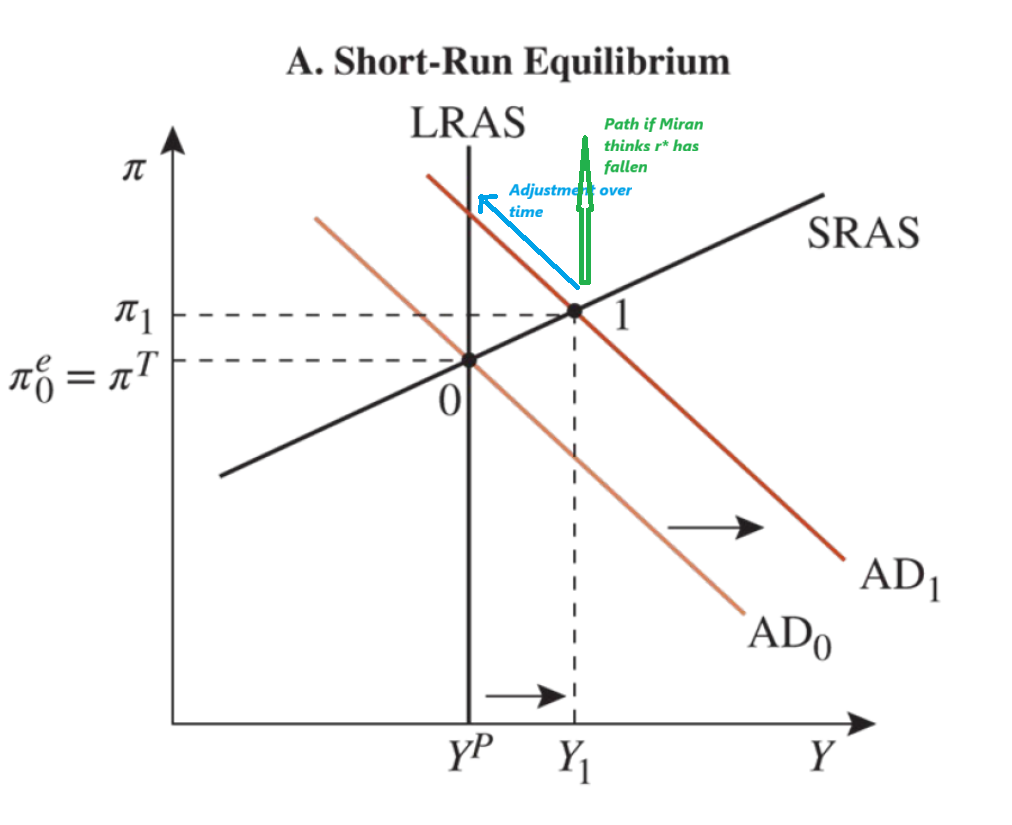

Despite the current stagnation, there is optimism that real consumption may see an uptick in August, as indicated by the recently released Q2 GDP data. However, it is important to recognize that these figures are retrospective and may not fully capture the potential deceleration suggested by the Weekly Economic Index (WEI) and the Weekly Economic Conditions Index (WECI), which both indicate a cooling trend as we head into September.

The implications of these findings are profound. For many households, flat personal income amidst rising costs can lead to difficult choices about spending and saving. This situation underscores the necessity for policies that promote wage growth and income equity, ensuring that all Americans can participate fully in any economic recovery.

As we await the final data for August, the narratives surrounding consumption and personal income will remain critical. Policymakers must take heed of these indicators and work to create an environment that fosters economic stability and growth, particularly for the most vulnerable members of society.

In conclusion, while there may be signs of growth in certain areas, the overall economic landscape presents significant challenges that must be addressed to ensure a truly inclusive recovery. The data collected in the coming weeks will be vital for determining the next steps in economic policy and for understanding the ongoing struggles that many Americans face in their daily lives.