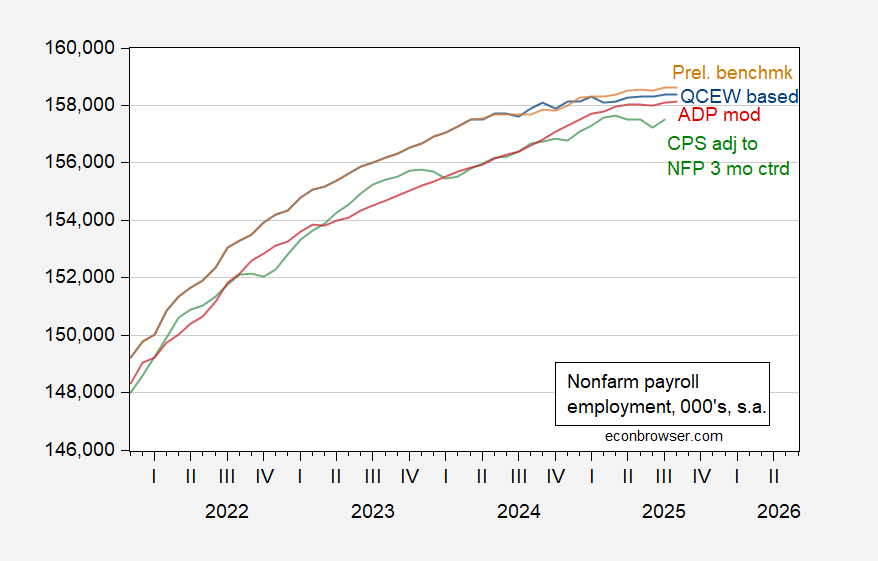

As the government shutdown continues, many are left wondering about the implications of delayed economic data releases. The postponement of the employment situation report has raised eyebrows, leading some to speculate if the Administration is feeling relieved about the delay. While we cannot definitively answer that question without insider knowledge, recent data from the ADP-Stanford Digital Economy Lab shows a surprising drop in private non-farm payroll employment, with an 82,000 job loss. This figure, while not catastrophic, certainly lacks the reassurance many were hoping for.

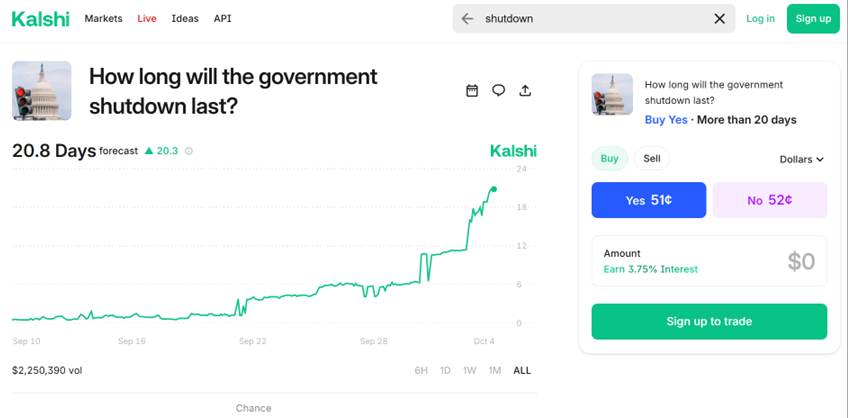

Current projections from Kalshi indicate a government shutdown lasting approximately 20.8 days, which will inevitably push back the timelines for key economic indicators such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). These crucial reports are now scheduled for release on October 15 and October 16, respectively.

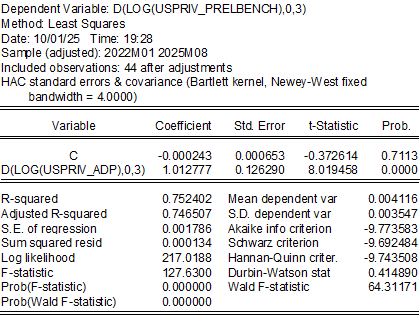

For context, the consensus estimate for non-farm payroll (NFP) employment was set between 50,000 and 54,000 new jobs, a figure that hardly inspires confidence in economic recovery. My own nowcasting, which is based on quarter-over-quarter changes in ADP private NFP, suggests that we may not be out of the woods yet. Meanwhile, the nowcasts for CPI, generated from a statistical model utilized by the Cleveland Federal Reserve, paint a similarly uncertain picture.

Economic analysts are increasingly concerned about the ramifications of these delays. The release of the CPI is particularly significant, as it serves as a key indicator of inflationary trends, which directly affect consumer purchasing power and overall economic health. The uncertainty surrounding the upcoming CPI data is palpable, especially given the delayed employment figures, which could influence Federal Reserve policy decisions moving forward.

In a recent analysis, we see that the instantaneous inflation metrics for both headline CPI and core CPI indicate a troubling upward trend, as presented in the most recent data from the Cleveland Fed. This trend could exacerbate existing concerns over inflation if the forthcoming reports reveal higher-than-expected figures.

As we await these critical economic indicators, the question remains: how will these delays affect both consumer confidence and policymaking in the coming weeks? With the government shutdown disrupting the usual flow of information, analysts and policymakers alike are left to navigate an increasingly murky economic landscape. The stakes are high, and the outcomes of these delayed reports could have lasting effects on the economy and the lives of millions of Americans.