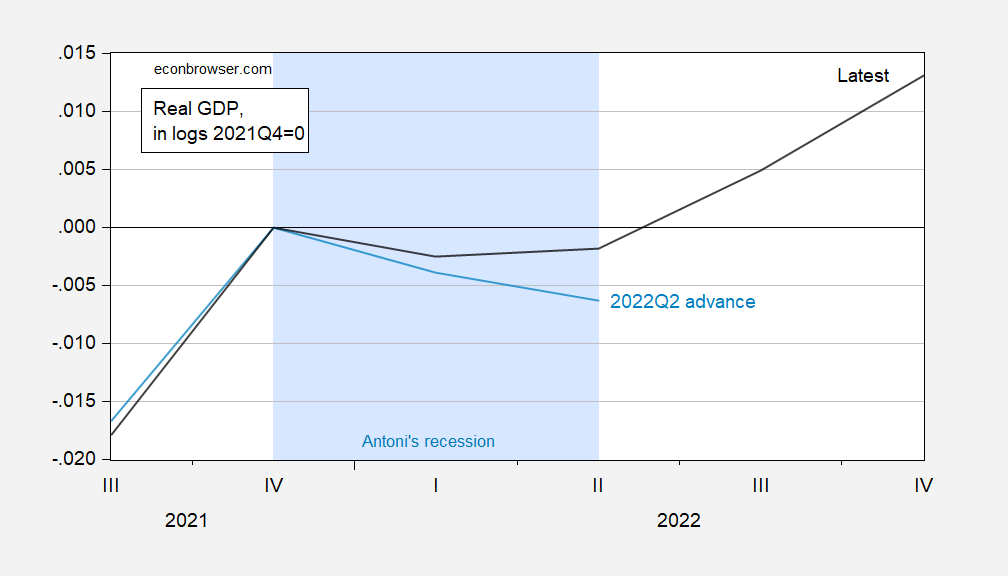

Relying solely on Gross Domestic Product (GDP) figures can create an overly optimistic view of the economic recovery, misleading many into believing that we are on the path to reclaiming pre-Trump levels of growth. Recent analyses highlight the importance of considering “Core GDP,” a term coined by economist Jason Furman, which focuses on the final sales to private domestic purchasers as a more accurate indicator of economic health.

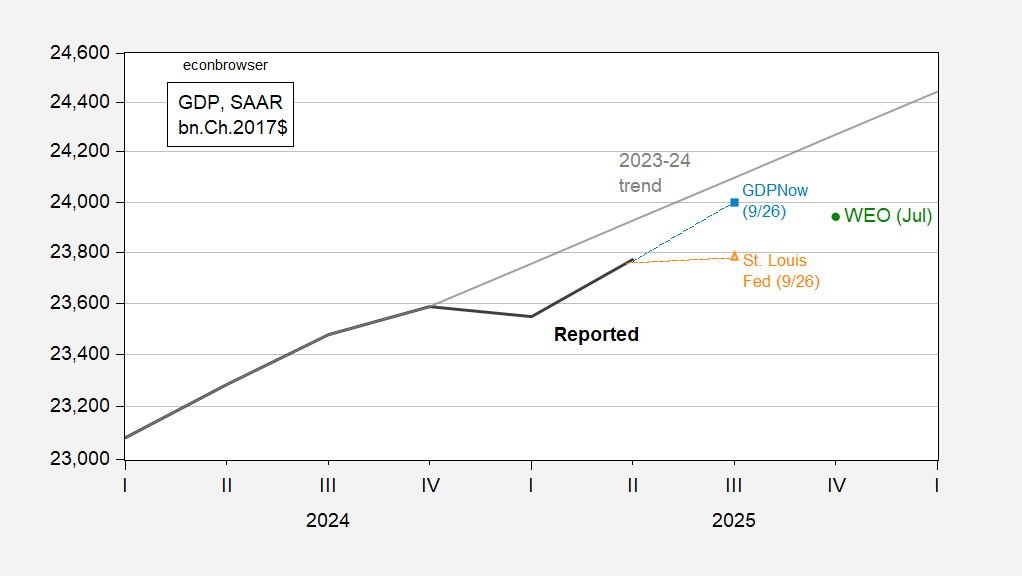

The latest data from the Atlanta Federal Reserve suggests a resurgence in GDP, but a closer examination reveals that this trajectory may not be sustainable. Core GDP provides a clearer understanding of aggregate demand and its evolution, especially in the context of ongoing measurement challenges related to imports and inventory fluctuations due to tariff implementations.

Figures from economic forecasts illustrate this disconnect. Even with a relatively optimistic outlook from the Atlanta Fed’s nowcast, the reality is that private domestic aggregate demand has not rebounded to its pre-pandemic levels. This discrepancy is vital for policymakers and citizens alike, as it underscores the necessity of a more nuanced approach to understanding economic conditions.

By emphasizing Core GDP, we can better gauge the true state of our economy and make informed decisions that prioritize the needs of working families and communities. As we move forward, it is crucial to remain vigilant and critical of economic indicators, ensuring that our interpretations reflect the lived experiences of everyday Americans rather than relying on surface-level statistics that may gloss over deeper issues.