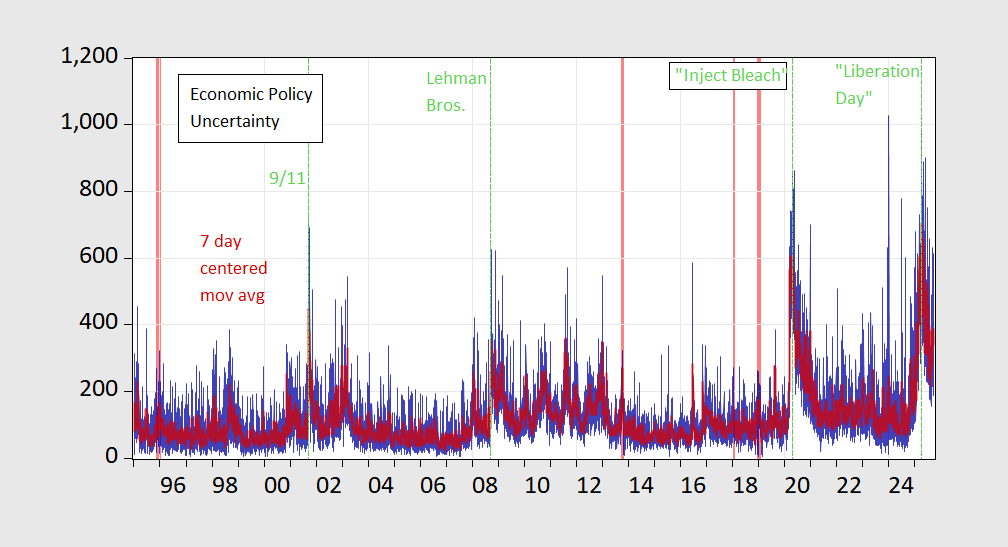

As the nation grapples with the implications of government shutdowns, a pressing question arises: what impact do these shutdowns have on economic policy uncertainty? Recent analysis using the Baker, Bloom, and Davis index reveals that while economic policy uncertainty (EPU) does indeed spike during government shutdowns, this increase is relatively minor when compared to the profound disruptions caused by events like the Covid-19 pandemic, controversial health advice, and significant historical moments such as “Liberation Day.”

The EPU index serves as a crucial indicator of how uncertain the economic landscape feels to businesses, policymakers, and consumers. During periods of government shutdown, many stakeholders experience a sense of trepidation regarding future economic conditions. However, the data suggests that the fluctuations in EPU during these shutdowns are often overshadowed by the seismic shifts triggered by more catastrophic events.

For instance, the onset of the Covid-19 pandemic, which was characterized by a swift and significant disruption to everyday life and economic activity, induced a far more pronounced spike in economic policy uncertainty than typical government shutdowns. The confusion and chaos surrounding public health advice—most infamously the ill-fated suggestion to use bleach as a treatment—contributed to a climate of fear and unpredictability.

Similarly, the historical context of “Liberation Day,” which marked a significant turning point in U.S. foreign policy and military engagement, also produced dramatic spikes in economic policy uncertainty. The consequences of such pivotal events resonate far beyond the immediate political reactions, affecting global markets and domestic economic conditions in ways that government shutdowns typically do not.

In analyzing these trends, it becomes clear that while government shutdowns certainly create a ripple effect of uncertainty, they lack the capacity to generate the same level of economic upheaval as larger, more impactful events. This distinction is essential for understanding how different types of crises influence the economic landscape and the decision-making processes of both businesses and consumers.

As we continue to navigate the complexities of governance and its repercussions on the economy, it’s vital to recognize the varying degrees of impact that different events have on economic policy uncertainty. By drawing these comparisons, we can better prepare for the challenges ahead and strive for a more stable economic future.