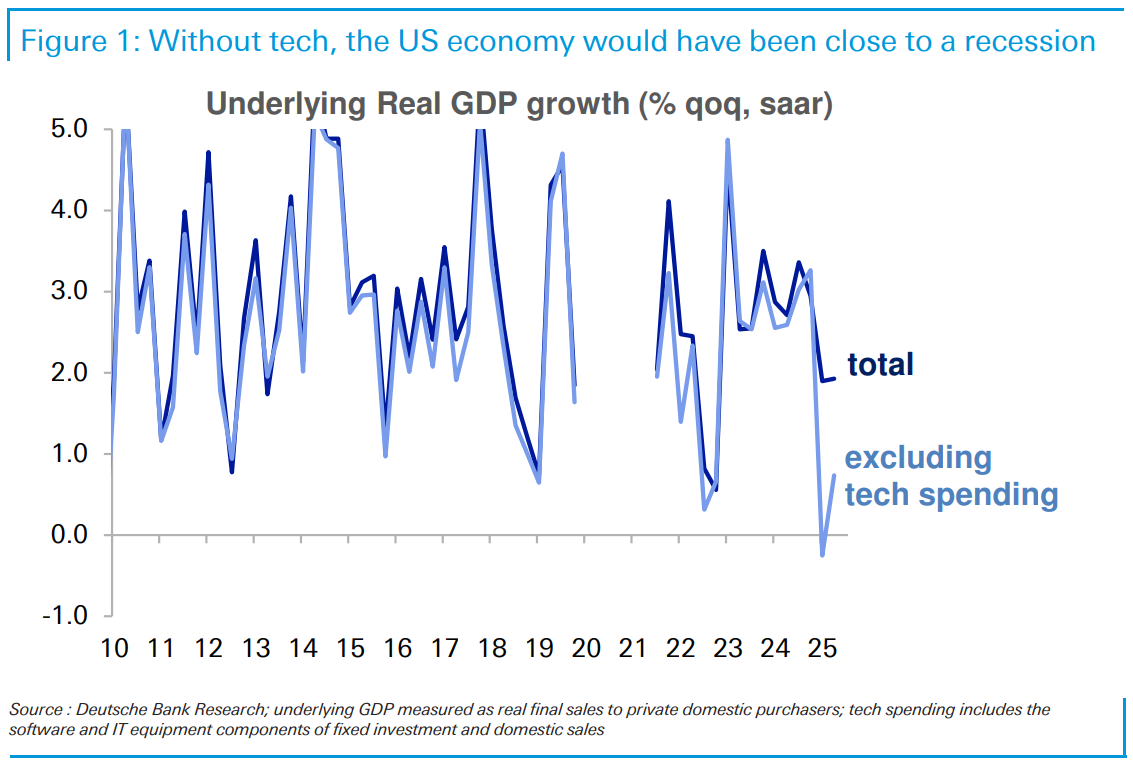

The relationship between U.S. GDP growth and technology spending has become increasingly critical, as highlighted by recent economic analyses. Data reveals that the strength of the American economy is significantly tied to the robust performance of technology investments in the market.

According to a recent report from the OECD’s Economic Outlook Interim Report, dated September 2025, the correlation between GDP growth and tech spending is evident. As sectors reliant on technology flourish, they are driving the overall economic recovery, underscoring the importance of this industry in maintaining momentum in the U.S. economy.

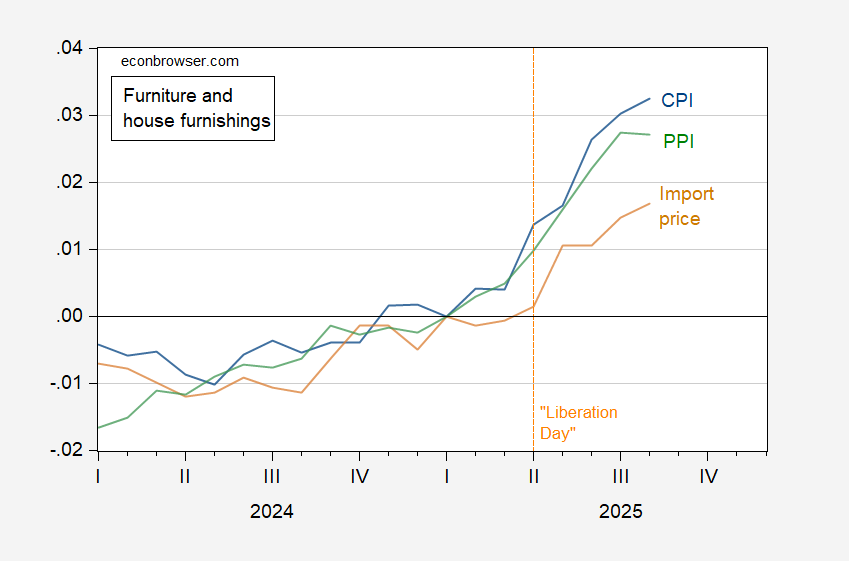

The latest figures show that since January 2021, the Consumer Price Index (CPI) has surged approximately 23%. Despite this inflationary pressure, the LSEG ex-technology index has only increased about 20% in real terms, translating to a modest growth rate of just over 5% annually. This stagnation in growth outside the tech sector raises concerns about the sustainability of the current economic trajectory.

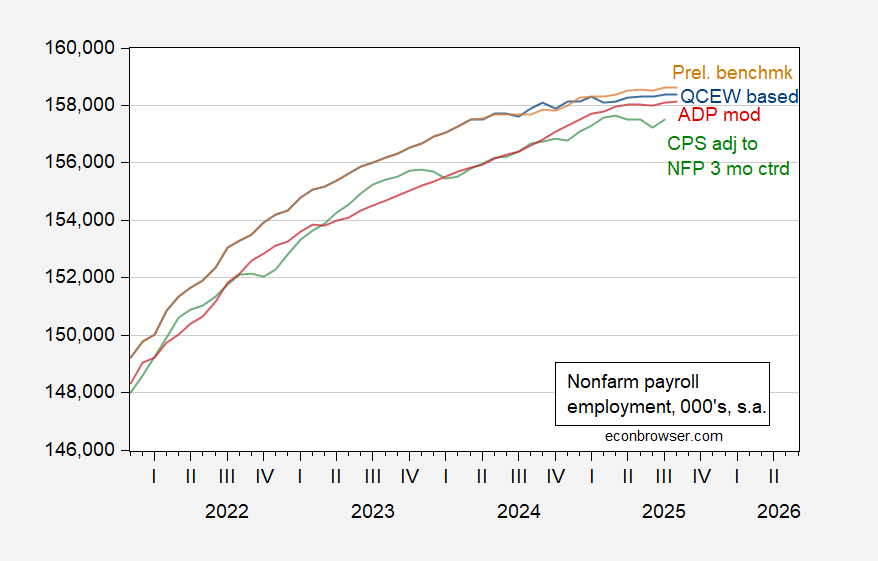

Moreover, when examining nominal returns, the Russell 2000, which tracks small-cap firms, has remained stagnant at levels similar to those seen at the end of 2022. This stagnation suggests that while technology stocks are thriving, broader market segments are lagging behind, highlighting a concerning concentration of economic returns in the tech industry.

As the tech sector continues to grow, it is becoming increasingly clear that the future of U.S. GDP growth is heavily reliant on the sustained success of information technology-related stocks and investment. If this growth were to falter, it could have far-reaching implications for the overall economy.

This dependency on technology is not just a passing trend; it reflects a deeper shift in how economic growth is generated in the modern age. With the ongoing digital transformation across various industries, the tech sector serves as a critical engine driving productivity and innovation.

An addendum from renowned economist Ed Yardeni further emphasizes this point, illustrating the “magnificent seven” tech stocks that have dominated the market. As these companies continue to perform well, they are not only boosting their own valuations but also propelling the stock market and, by extension, the economy as a whole.

In summary, while the technology sector remains a beacon of hope for continued economic expansion, it also poses risks if its growth stalls. To ensure a balanced and sustainable recovery, it is essential for policymakers and investors to pay close attention to the dynamics within the tech industry, while also fostering growth in other sectors of the economy. The reliance on tech spending, while beneficial in the short term, calls for a reevaluation of how diverse and resilient the U.S. economy can be in the face of future challenges.