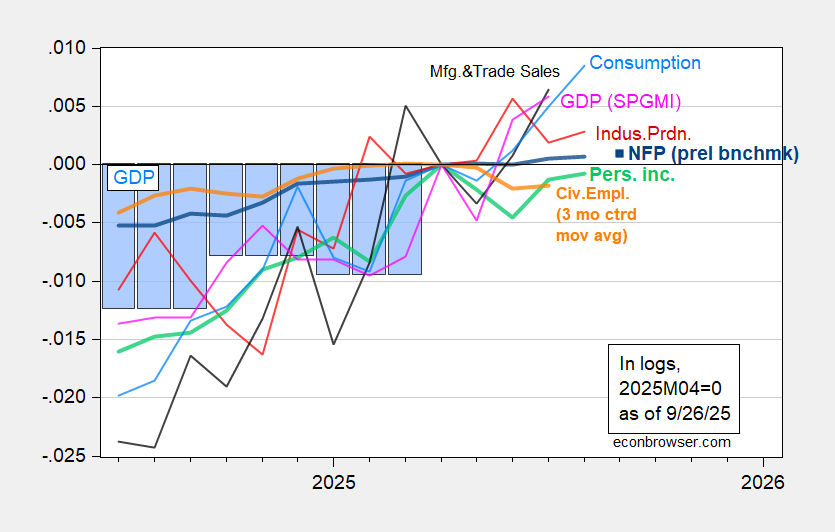

As we delve into the economic landscape following the release of personal income data for August, a concerning picture emerges regarding key indicators monitored by the National Bureau of Economic Research’s Business Cycle Dating Committee (BCDC). Notably, personal income excluding current transfers and employment figures carry significant weight in assessing the health of our economy.

Recent statistics reveal that the Nonfarm Payroll (NFP) data for August is merely 0.07% above the levels recorded in April, while the Bloomberg consensus predicts a modest net gain of 39,000 jobs for September, just 0.09% higher than April’s figures. Furthermore, the three-month centered moving average of civilian employment sits at 0.2% below the April threshold, indicating that employment growth has stagnated. In both raw and averaged forms, civilian employment is trailing its recent peak, leading experts to describe the current employment situation as “dead in the water.” For those who believe that shifts in civilian household employment trends can be predictive of recessions, such stagnation is a cause for concern and warrants close attention.

Alongside these employment figures, alternative indicators, including a new early benchmark from the Philadelphia Fed, paint a similarly bleak picture. The early benchmark value for July reflects only a 0.05% increase over the levels recorded in April. For proponents of private employment series over government statistics, it’s worth noting that the ADP-Stanford Digital Lab’s private employment data shows only a 0.2% rise since April, further emphasizing the sluggishness of job growth.

Despite the disheartening labor market statistics, there’s an intriguing paradox: consumption growth appears to be continuing, even as real personal income trends sideways. This could indicate that households are drawing from their savings, maintaining optimism about future disposable income — a sentiment that seems at odds with the results of household surveys — or accelerating spending in anticipation of potential future tariffs.

Overall, the data available through August suggests that the economy has not yet slipped into negative growth across key dimensions of economic activity. However, higher frequency data collected through mid-September points toward an impending slowdown, raising flags for what lies ahead.

As we continue to analyze the evolving economic landscape, these indicators serve as crucial signposts of where we may be headed. The persistent challenges in employment and stagnant personal income levels underscore the need for policymakers to take proactive measures to stimulate growth and safeguard the livelihoods of working families across the nation.