Why is the United States considering a substantial $20 billion credit line for Argentina? This question looms large as discussions unfold around the proposed financial support. Many are left wondering about Argentina’s significance to U.S. national security and economic interests, especially given the intricate dynamics of international finance and geopolitics.

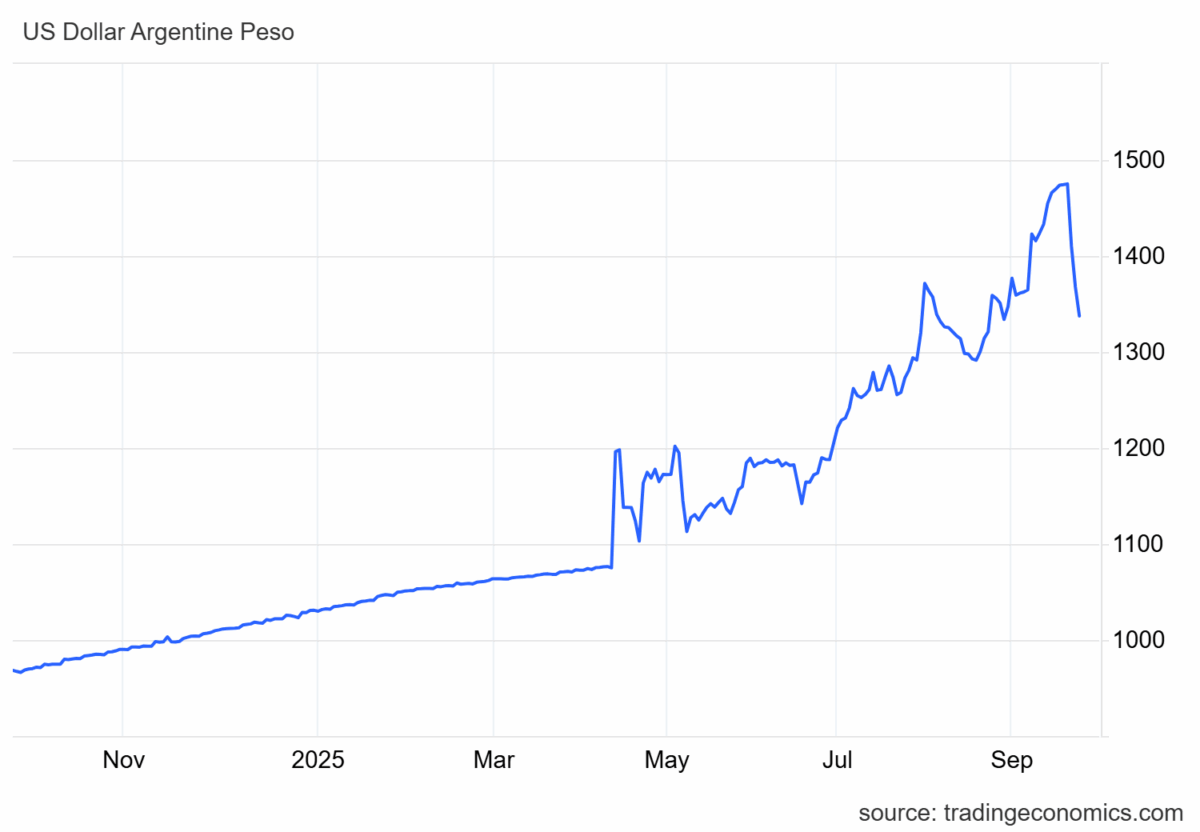

Recent reports have surfaced, including a piece by Bloomberg, that delve into the details of this potential financial arrangement. However, the article lacks a comprehensive explanation of the economic rationale behind such a significant commitment. Critics are voicing concerns that without specific conditions tied to Argentina’s currency valuation—currently pegged at an overvalued rate—this financial aid could amount to a squandered investment. As Mark Sobel pointed out in a recent New York Times article, the lack of conditionality raises red flags about the efficacy of this support.

Moreover, many experts are questioning whether the U.S. should be collaborating closely with the International Monetary Fund (IMF) regarding the stipulations attached to this credit line. The IMF has a long history of working with countries facing economic turmoil, and any financial assistance from the U.S. should ideally align with the broader framework established by this global institution.

Reflecting on past interventions, one can draw parallels between the current situation and the U.S. response to Mexico’s financial crisis in 1994. At that time, the Exchange Stabilization Fund (ESF) provided crucial support to Mexico, which had tangible collateral and a more stable economic outlook. In contrast, the question remains: what assets or guarantees does Argentina possess to justify such a sizable loan? As the debate continues, it will be interesting to see if those who criticized the U.S. intervention in Mexico will now weigh in on the current proposal for Argentina.

As we navigate the complexities of international finance, the implications of this potential credit line extend far beyond mere numbers. It is essential to consider the broader context of U.S.-Latin America relations, the economic stability of Argentina, and the lessons learned from past financial interventions. The outcome of this situation could have lasting effects on both the region and U.S. foreign policy, making it a critical moment to reflect on the responsibilities that come with financial power on the global stage.