In a recent address to the Economic Club of New York, Federal Reserve Governor Stephen Miran, currently on leave from the White House Council of Economic Advisers (CEA), delivered a speech that stirred confusion and debate among economists and policymakers alike. Titled “Nonmonetary Forces and Appropriate Monetary Policy,” Miran’s remarks prompted scrutiny, particularly regarding his shifting views on the neutral interest rate, known as r*.

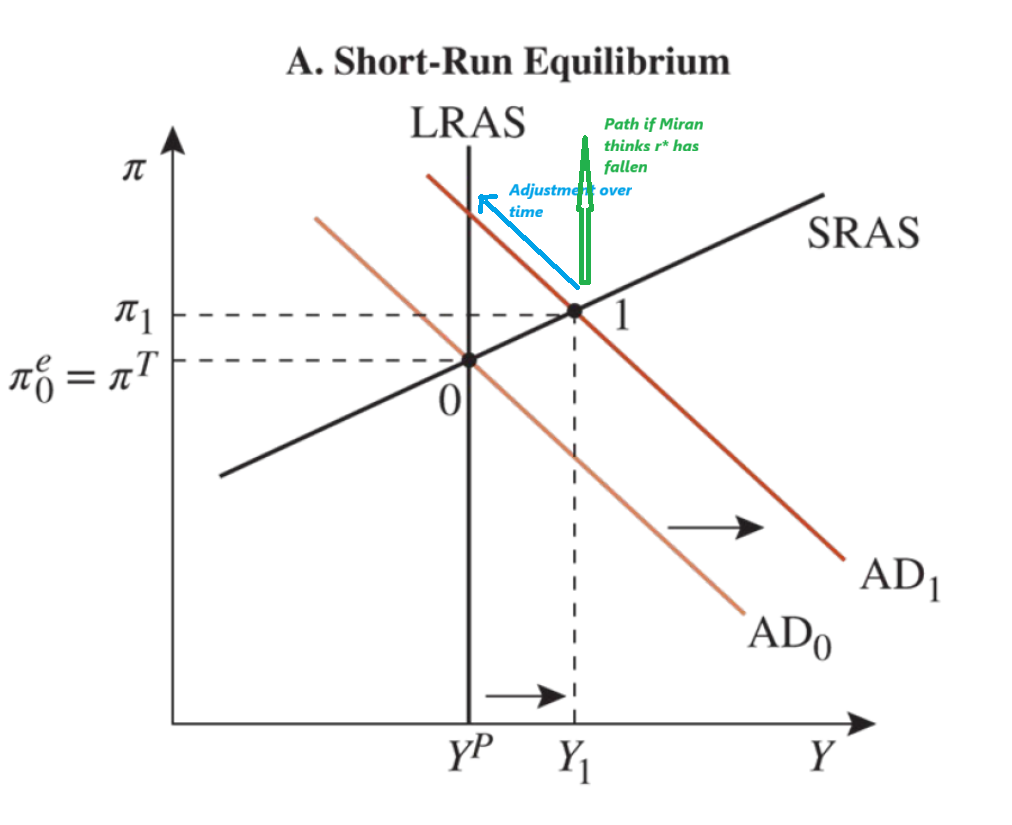

Jonathan Levin, writing for Bloomberg Opinion, highlighted a notable contradiction in Miran’s positions. Before his CEA appointment, Miran claimed that r* had increased, but in his recent speech, he suggested it had decreased. This inconsistency raises questions about the underlying factors influencing r* and the broader implications for monetary policy.

One section of Miran’s speech attracted particular attention, where he discussed how higher tariff revenues could lead to a reduction in r*. He pointed out that this outcome is intricately linked to unmentioned cuts in income tax revenue. Miran argued that trade renegotiations and the recent tax legislation passed by Congress would likely increase national saving, thereby impacting the net supply of loanable funds.

Miran elaborated on the relationship between tariffs and economic dynamics, stating that even minor adjustments in the prices of certain goods have elicited excessive concern. He posited that exporting nations would have to lower their prices in response to tariffs, while also suggesting that these tariffs would lead to significant shifts in national saving. He referenced the Congressional Budget Office’s estimates, which suggest that tariff revenue could reduce the federal budget deficit by over $380 billion annually over the next decade. This reduction in the deficit would, in turn, alter the balance of supply and demand for loanable funds, resulting in a notable impact on r*.

According to Miran, a one-percentage point change in the deficit-to-GDP ratio could shift r* by nearly four-tenths of a percentage point. He further noted that a 1.3 percent increase in national saving would lead to a reduction in the neutral rate by half a percentage point. Miran emphasized that tariffs are not the sole factor influencing the supply of loanable funds. He pointed to loans and loan guarantees from East Asian countries, which have reached an impressive $900 billion in exchange for relatively low tariff ceilings, contributing to an exogenous increase in credit supply.

The effects of the recently passed tax law were also prominent in Miran’s analysis. He asserted that this legislation would have a strong positive impact on national saving, estimating an increase of $3.83 trillion over the next decade, relative to previous policy baselines. This increase, amounting to approximately 1.3 percent of GDP, would similarly lead to a reduction in r* by half a percentage point.

Miran noted that the federal deficit during the second and third fiscal quarters of this year was nearly $140 billion lower than the same period the previous year, indicating a trend towards a more favorable fiscal position. However, he also acknowledged that the tax law is expected to drive annual investment increases of up to 10 percent in the coming years, which would correlate with a rise in r* and, consequently, a potential increase in the appropriate federal funds rate.

Despite the positive outlook presented by Miran, some analysts expressed skepticism regarding his conclusions. Critics pointed out that while tariff revenues are indeed rising, they cannot compensate for the substantial deficit created by other legislative measures, such as the OBBBA. If Miran’s argument hinges on the notion that r* has decreased, detractors suggest he should also acknowledge the possibility that r* may have actually risen.

Moreover, the dynamic estimates of revenue growth linked to the OBBBA and prior deregulation efforts have been met with skepticism, with some economists labeling Miran’s reliance on CEA assessments as overly optimistic. Should r* be interpreted as having risen, advocates for lower interest rates would need to advocate for a higher target inflation rate, a concept supported by traditional New Keynesian models.

As the discussion surrounding Miran’s speech continues, the implications of his arguments will undoubtedly shape future economic policy debates. With the Fed’s decisions directly impacting the lives of millions, the clarity and integrity of these economic analyses will be crucial in navigating the complexities of the current economic landscape.