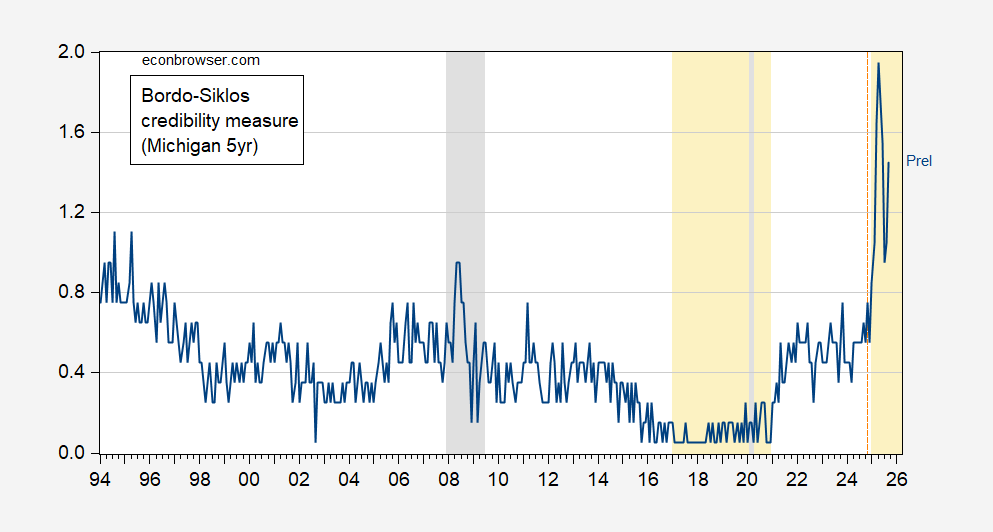

In the complex landscape of modern economics, the credibility of the Federal Reserve (the Fed) plays a crucial role in maintaining stability and confidence in financial markets. Recent discussions have raised concerns that this credibility is coming under siege, with significant implications for inflation and economic health. If the Fed’s credibility continues to deteriorate, it could lead to a troubling shift from isolated price level increases, often triggered by tariffs, to more pervasive inflationary pressures across the economy.

A recent analysis highlighted by Bloomberg presents a stark warning. The Fed’s decisions, particularly those perceived as yielding to political pressures, could introduce a new layer of risk into U.S. financial markets and the value of the dollar. David Kelly, the chief global strategist at JPMorgan Asset Management, articulated this concern, emphasizing that any indication of capitulation to external forces could threaten the very foundation of the Fed’s authority and operational effectiveness.

The implications of such a scenario are profound. Inflation, which has already been a worry for many Americans, could become more rampant if the Fed is seen as losing its grip on monetary policy. This situation not only undermines consumer confidence but also poses a risk to long-term economic growth. A central bank that cannot maintain its independence is one that risks losing its ability to make decisions based on economic fundamentals rather than political expediency.

The troubling trend of undermining the Fed’s credibility has historical roots. Political interference in central banking has often led to disastrous consequences. The economic turmoil of the 1970s, characterized by stagflation—a rare combination of stagnant growth and high inflation—serves as a reminder of what can happen when monetary policy is influenced by short-term political considerations. The Fed must navigate these pressures carefully to avoid repeating the mistakes of the past.

In recent years, various administrations have exerted pressure on the Fed, often in pursuit of immediate political gains. The current climate, where economic decisions can be swayed by the whims of politicians, poses a significant threat to the institution’s ability to function effectively. The Fed must be allowed to operate independently, guided by data and research rather than political agendas. If this independence is compromised, the risk of inflation could escalate, resulting in a ripple effect throughout the economy.

Furthermore, the credibility of the Fed is not just an abstract concept; it has tangible effects on the average citizen. When people lose faith in the central bank’s ability to control inflation, they may adjust their spending and saving behaviors in anticipation of rising prices. This can create a self-fulfilling prophecy, where expectations of inflation lead to actual inflation, thus perpetuating a cycle that is difficult to break.

The economic landscape is fraught with challenges, and the Fed’s role is more critical than ever. As it grapples with the fallout from the COVID-19 pandemic, supply chain disruptions, and geopolitical tensions, maintaining credibility is paramount. Policymakers must be vigilant and prioritize the Fed’s independence to ensure effective monetary policy.

In conclusion, the Fed’s credibility is under threat, and this erosion could have dire consequences for inflation and economic stability. As political pressures mount, it is essential to safeguard the independence of the Federal Reserve. The stakes are high, and Americans deserve a central bank that can act without fear of political retribution, focusing solely on the economic well-being of the nation. Ensuring that the Fed remains a stable and credible institution is not just a matter of policy; it’s a matter of protecting the future of our economy.