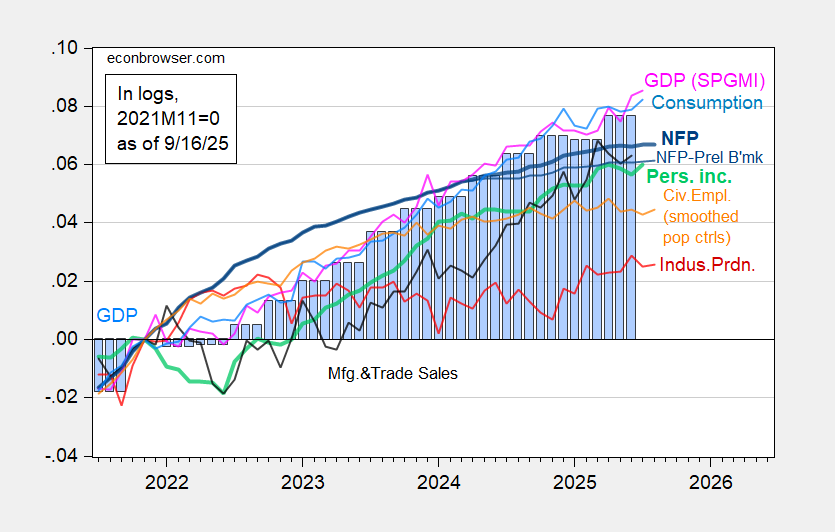

As we reach mid-September, the economic landscape presents a complex picture, marked by notable gains in industrial and manufacturing production as well as retail sales. Recent data indicates that these sectors have surpassed consensus expectations, offering a glimmer of hope amidst ongoing uncertainties. However, despite these positive trends, there remains a pervasive sense of stagnation, with many indicators showing a tendency to trend sideways.

The latest figures reveal that industrial production has outperformed projections, showcasing resilience in the manufacturing sector. This uptick reflects a robust recovery that has defied some of the more pessimistic forecasts that have circulated in recent months. Retail sales have also posted impressive numbers, suggesting that consumer confidence remains strong even as broader economic concerns loom.

Yet, as we delve deeper into the data, it becomes clear that this apparent growth is accompanied by a cautious undercurrent. While the increases in industrial and retail performance are commendable, they are juxtaposed against a backdrop of economic indicators that are not moving decisively in one direction or another. This trend of sideways movement raises questions about the sustainability of the current economic momentum.

On one hand, the strength in industrial production signals a revitalization of manufacturing, which is often seen as a cornerstone of economic health. The ability of manufacturers to exceed expectations is a positive sign that businesses are adapting and finding ways to thrive despite challenges such as supply chain disruptions and labor shortages. This adaptability could bode well for future growth if sustained.

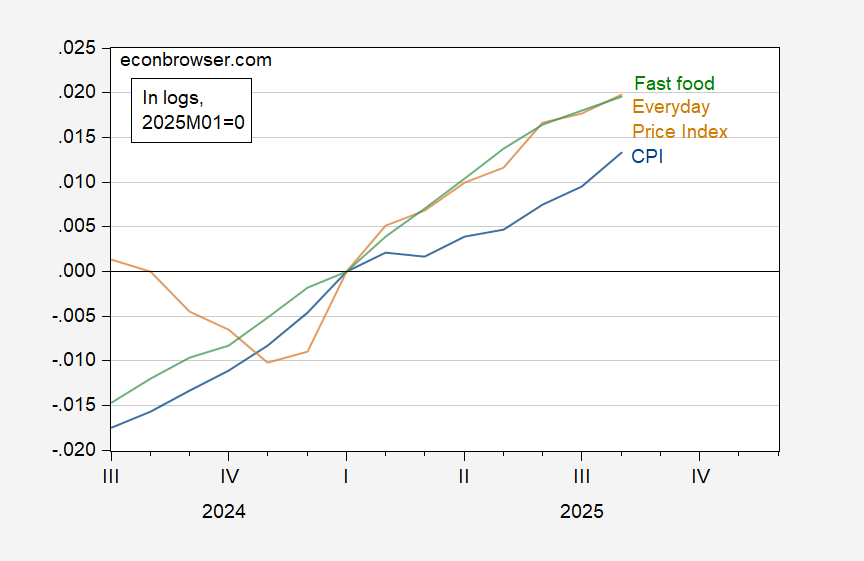

Conversely, the mixed signals in the economy suggest that caution is warranted. The sideways trend observed in various economic indicators could signify underlying vulnerabilities that have yet to be addressed. For instance, while retail sales are climbing, they must be viewed in the context of inflationary pressures that could erode purchasing power. Consumers may be spending more, but that does not necessarily translate to an equivalent increase in real economic activity when adjusted for inflation.

Moreover, the labor market continues to be a focal point of economic discourse. Employment figures, including nonfarm payroll data, have shown fluctuations that reflect both the resilience and fragility of the job market. While job creation remains a priority, the quality of those jobs and the wages associated with them are critical for ensuring long-term economic stability.

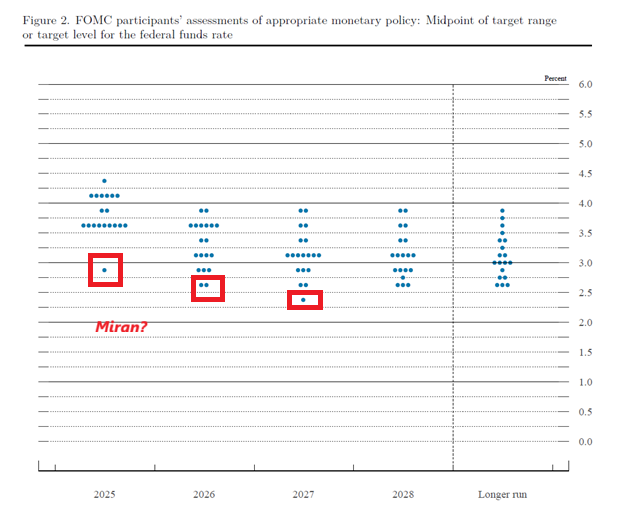

As we navigate this economic landscape, it becomes increasingly clear that a multifaceted approach is necessary to address the complexities at play. Policymakers must remain vigilant and responsive to the evolving economic conditions, ensuring that support measures are in place to foster growth while also mitigating risks that could derail progress.

In summary, while the recent uptick in industrial and retail sectors provides a hopeful narrative, the broader economic picture remains nuanced. The tendency toward sideways movement in key indicators calls for a balanced perspective that recognizes both achievements and challenges. The coming months will be crucial in determining whether these positive trends can translate into sustained economic growth or if they will falter in the face of persistent headwinds.