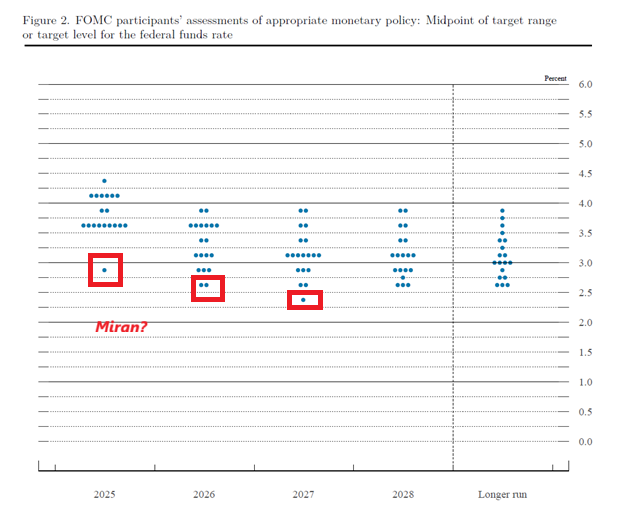

In a recent Federal Open Market Committee (FOMC) meeting held on September 17, 2025, the committee voted to reduce the federal funds rate by 25 basis points, with one notable dissent from Stephen Miran, who argued for a more aggressive cut of 50 basis points. This decision underscores the ongoing debate within economic circles about the appropriate monetary policy in the current economic climate.

Miran’s dissent is particularly intriguing, as it reflects a belief in a significantly more robust economic growth trajectory than the majority of his peers. His perspective aligns with the Troika forecast, which anticipates faster growth rates. However, this optimism contrasts sharply with the FOMC’s broader outlook, leaving Miran somewhat isolated in his views.

The FOMC’s latest projections reveal a consensus that the growth rates expected in 2026 and beyond are slightly lower than those forecasted by the Troika. This divergence raises questions about the accuracy and reliability of various economic predictions, especially considering the current inflationary pressures that have been felt across the nation. Miran’s position, which posits a much faster GDP growth alongside lower inflation, suggests he is banking on what some might describe as a “supply-side miracle.” This belief is not widely shared among his colleagues, indicating a fundamental rift in economic strategy.

The discussions within the FOMC highlight the complexities of navigating economic policy amid uncertainty. While Miran’s optimistic outlook may resonate with some, it remains to be seen whether such a perspective can hold up against the realities of inflation, supply chain disruptions, and other macroeconomic challenges that have plagued the recovery process.

The FOMC’s decision to lower interest rates reflects an understanding of the need to stimulate economic activity, particularly in light of the recent slowdown. However, the dissenting opinion from Miran illustrates a critical debate about the speed and extent of such policy changes. As the committee continues to grapple with these issues, the differing views on growth and inflation will likely shape the future of U.S. monetary policy.

In summary, the FOMC’s recent meeting and the resulting decisions underscore the ongoing tensions within economic policymaking. As Miran stands out with his contrarian views, the broader economic landscape remains uncertain, inviting continued scrutiny and discussion about the best paths forward for economic recovery and growth. The coming months will be critical in determining whether the differing projections will converge or continue to diverge, influencing both policy decisions and the everyday lives of Americans.