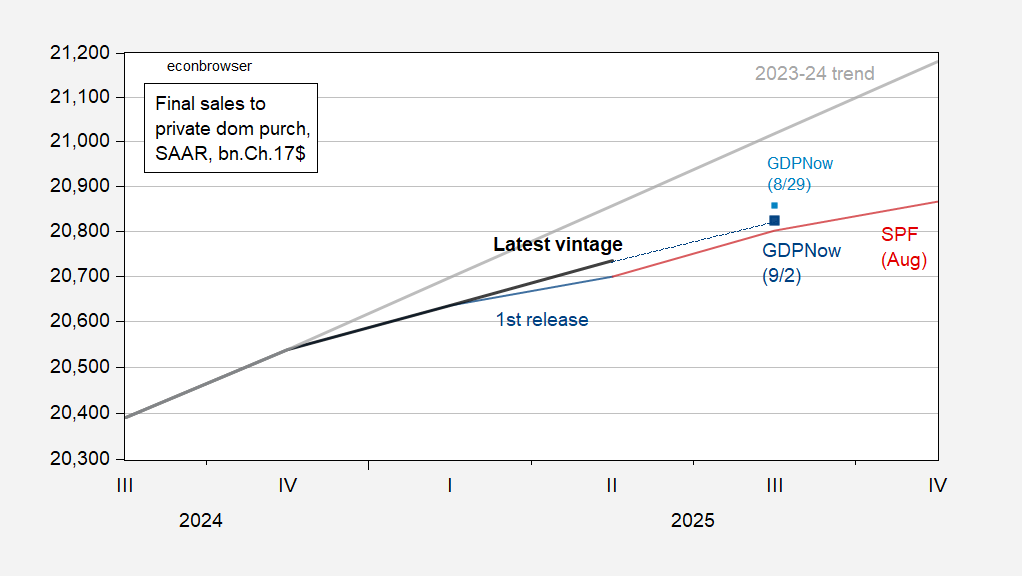

Q2 final sales to private domestic purchasers — arguably a better indicator over time about momentum in the economy in the wake of the tariff-frontrunning — was 1.9% q/q AR. Four days ago, nowcasted final sales for Q3 was 2.4%. Today’s GDPNow release takes that number down to 1.7%, a slowdown from Q2.

Figure 1: Final sales to private domestic purchasers, latest vintage (bold black), advance release (blue), GDPNow of 8/29 (light blue square), GDPNow of 9/2 (dark blue square), Survey of Professional Forecasters August median (dark red), 2023-24 stochastic trend (gray), all in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, and author’s calculations.

The downward revision was associated with the ISM manufacturing survey and the construction release. (Q3 GDP nowcast was reduced from 3.5% to 3%, q/q AR.). Manufacturing PMI was at 53.0 (vs. 53.3 Bloomberg consensus), while construction m/m was -0.1% (at consensus).