Today we present a guest post written by Matías Scaglione of the data science and economic consulting firm Motio Research.

On August 7, 2025, Stephen Moore, Senior Visiting Fellow at the Heritage Foundation, presented monthly household income figures at the White House alongside President Trump (video; charts). Moore described the data as “never seen before,” claimed it came from unpublished Census Bureau sources, and reported that from January through June 2025, real median household income for “the average American family” (sic) had risen by $1,174. He also compared changes in real household income across the 25th, 50th, and 75th percentiles between the first terms of Presidents Trump and Biden.

The appearance of monthly median household income estimates in such a high-profile political setting highlights both the public interest in timely measures of household economic well-being and the importance of clarity about how such estimates are produced.

Monthly household income estimates are not new — they were first introduced in 2011 by Sentier Research, which demonstrated how Current Population Survey (CPS) microdata could be used to produce robust monthly series. Sentier’s series was widely cited until the firm ceased operations in February 2020. At Motio Research, we have been producing such estimates since December 2023, building on Sentier’s work and incorporating methodological improvements that enhance stability and predictive performance. In this post, I compare our results with those presented at the White House, outline our methodology, and offer context on interpretation, prediction, and transparency.

What the Numbers Show — and What They Don’t

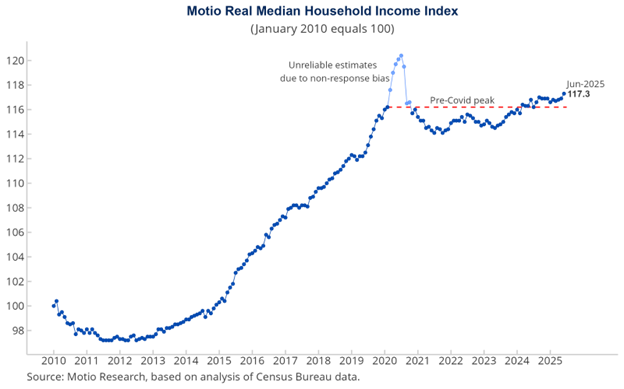

Moore’s reported $1,174 gain appears to represent the difference in real median household income between June 2025 and December 2024. By comparison, our seasonally adjusted, preliminary estimates show a smaller increase of $285 (0.34%), from $83,395 to $83,680. This equals an average monthly growth of 0.06% in early 2025, less than half the 0.16% rate of early 2024. While the growth of real median household income has been relatively weak during President Biden’s administration, the numbers for the first half of 2025 do not show extraordinary gains of the magnitude suggested by Moore’s estimates (see chart below).

Moore did not disclose the source of the data underlying his presentation. In a personal communication on August 11, he stated that his team had developed their own method and intended to release the full details within the following week. While details still remain to be seen, it is clear that his estimates are based on CPS microdata — the same public dataset employed by Sentier in the past and by Motio today.

It is also important to clarify how “monthly” household income estimates should be interpreted. Each estimate reflects household income reported over the prior 12 months, but because of the CPS sample rotation, the data in any given month actually combine four overlapping 12-month reference periods, effectively spanning up to 15 months. They are not measures of income earned within a single month. For example, the June 2025 estimate reflects incomes reported from April 2024 through June 2025. This means that the June 2025 figure still incorporates a substantial portion of income earned during President Biden’s last year in office. Month-to-month changes therefore capture shifts in overlapping twelve-month windows, rather than sudden changes in household finances.

Producing Monthly Household Income Estimates from CPS Microdata

The official U.S. Census Bureau estimates of median household income are published annually in September, covering the previous calendar year. They are based on the Annual Social and Economic Supplement (ASEC) to the Current Population Survey (CPS), which is designed specifically to collect detailed income data.

However, the monthly CPS — the main U.S. labor force survey — also includes a question on total income over the past twelve months, with responses recorded in a set of income intervals rather than exact dollar amounts. This makes it possible to produce valid monthly estimates of annual household income, even though the survey is not designed primarily for this purpose.

The consulting firm Sentier Research, led by two former senior Census Bureau officials, pioneered this approach in 2011, demonstrating that CPS microdata could be used to produce reliable monthly series of median household income. Sentier’s series was widely cited by national media and policymakers until the firm ceased operations in February 2020.

Motio Research builds directly on Sentier’s methodology, adopting its core design while incorporating several improvements that enhance the series’ stability and predictive performance. These improvements include refined income imputation methods, inflation adjustments at the microdata level, systematic benchmarking to Census annual estimates, and seasonal adjustment performed with the Census Bureau’s X-13ARIMA-SEATS program.

Interpreting 2020 — A Statistical Artifact

The chart presented by Moore at the White House included a dashed line in 2020, along with a note clarifying that the anomaly was due to nonresponse bias during the first months of the Covid pandemic. The language in this note is very similar to what we include in our own releases, and the period covered — March through October — is identical. Moore nevertheless disregarded both the dashed line and the accompanying note in his own chart, and treated the 2020 “peak” as though it reflected an actual economic event.

In reality, the sharp rise and fall in household income in 2020 was a statistical artifact caused by nonresponse bias in the CPS: lower-income households were less likely to respond, artificially raising measured median income. This bias is well documented and should be considered when using the series for historical comparisons.

Distributional Estimates and Inequality

As part of his White House presentation, Moore also showed comparisons of real household income at the 25th, 50th, and 75th percentiles between President Trump’s first term and President Biden’s term to date. His charts indicated that gains were larger at all percentiles under Trump, with the 25th percentile showing losses under Biden, the median essentially flat, and the 75th percentile increasing.

While the framing of these results was political, the general patterns in his charts are broadly consistent with what our own percentile series — introduced in June 2024 — has shown. Since their launch, we have documented in press releases and LinkedIn posts that the gap between the 75th and 25th percentiles increased after Covid. The 75th percentile recovered to pre-Covid levels much earlier than the median, while the 25th percentile only reached its pre-Covid peak in mid-2024, lagging behind the broader recovery. And as the chart above shows, median household income has grown more slowly in recent years than during the latter part of President Obama’s second term and the pre-Covid years of President Trump’s first term.

On Prediction

In an interview with The Washington Post, Moore said that his team had “devised a new model to use Census Bureau monthly data surveys to predict future releases of national income data,” and added: “This is going to be a big deal for us because no one else has just figured out how to do this.” Washington Post, August 7, 2025.

As noted earlier, monthly household income estimates have existed since 2011. While Sentier Research pioneered the method, to our knowledge it never used the series to forecast the Census Bureau’s official annual median household income figures. Motio Research began doing so in 2024, publishing our forecasts months ahead of the official release.

In May 2024, we projected a 6.7% increase in nominal median household income for 2023 — corresponding to a 2.6% real gain, the first since 2019. When the Census released its 2023 estimates in September, the official figures fell within our projected range (see blog post). For 2024, we project a 1.6% increase in nominal median household income, which translates into a 1.0% decline in real terms. The Census will release the official 2024 estimates next month.

Why Transparency Matters

Timely indicators of household income are valuable for assessing economic conditions and informing policy debates. When such figures are presented in political contexts, it is essential that their sources and methods are open to scrutiny. Without methodological transparency, it is difficult to evaluate whether differences in reported results reflect real economic changes or differences in data processing.

At Motio Research, our goal is to provide a consistent, reproducible, and transparent measure of monthly household income trends. Detailed methodological documentation and an interactive chart of the Motio U.S. Real Median Household Income Index are available at motioresearch.com/household-income-series.

Ultimately, what matters is not just the numbers themselves, but the clarity of the methods used to produce them. Household income is too important a measure of economic well-being to be reduced to political talking points. Reliable, transparent estimates allow us to understand how U.S. households are truly faring over time.

This post written by Matías Scaglione.